Free Tax Help for NM residents

Get help from IRS-qualified tax preparers

Funding free tax prep to low-income individuals & families

THE FINANCIAL RESOURCES PEOPLE NEED

Tax Help New Mexico is a free tax-filing resource for people whose household income is $67,000 or less. Effective immediately, our income limit for all clients, regardless of age, is set strictly at $67k to better serve our clients and manage our limited resources. Households exceeding this threshold will be directed to visit a CPA or a paid tax professional.

Disclaimer: Tax Help New Mexico does not provide tax advice. For tax advice, please visit a Certified Public Accountant (CPA) or a paid tax professional.

How to get Tax Help in new mexico

Tax Help New Mexico has filled all offseason appointments at this time. We will reopen appointments in 2026. Please revisit our website for updates around January 2026.

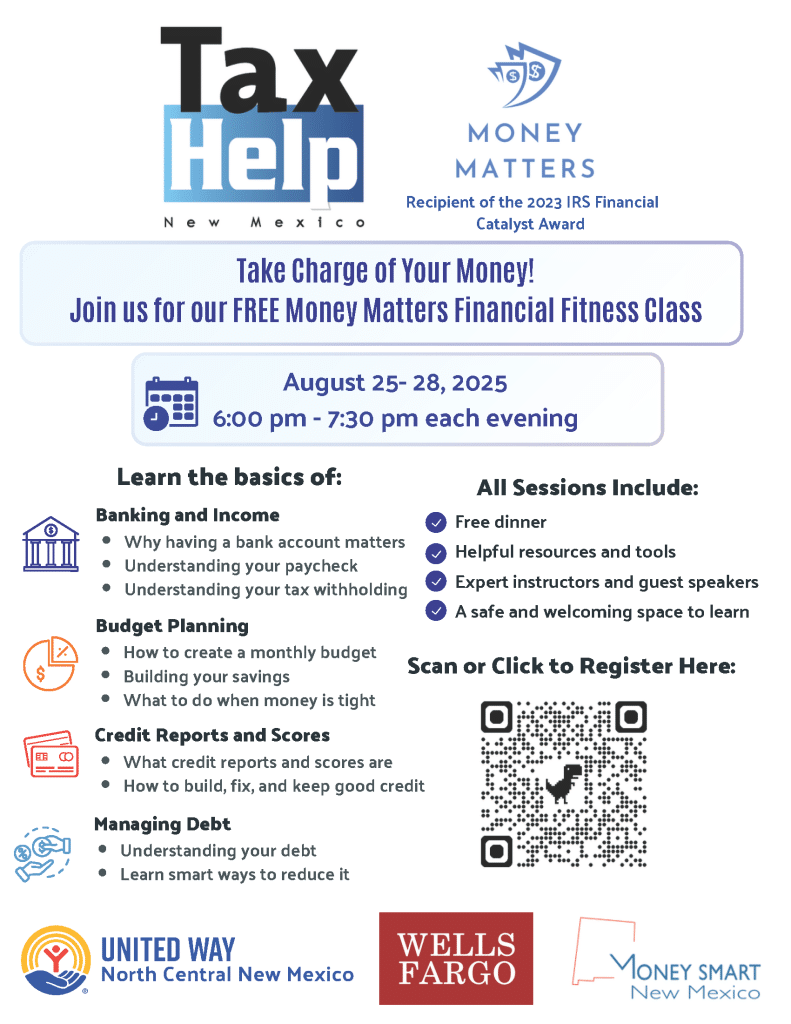

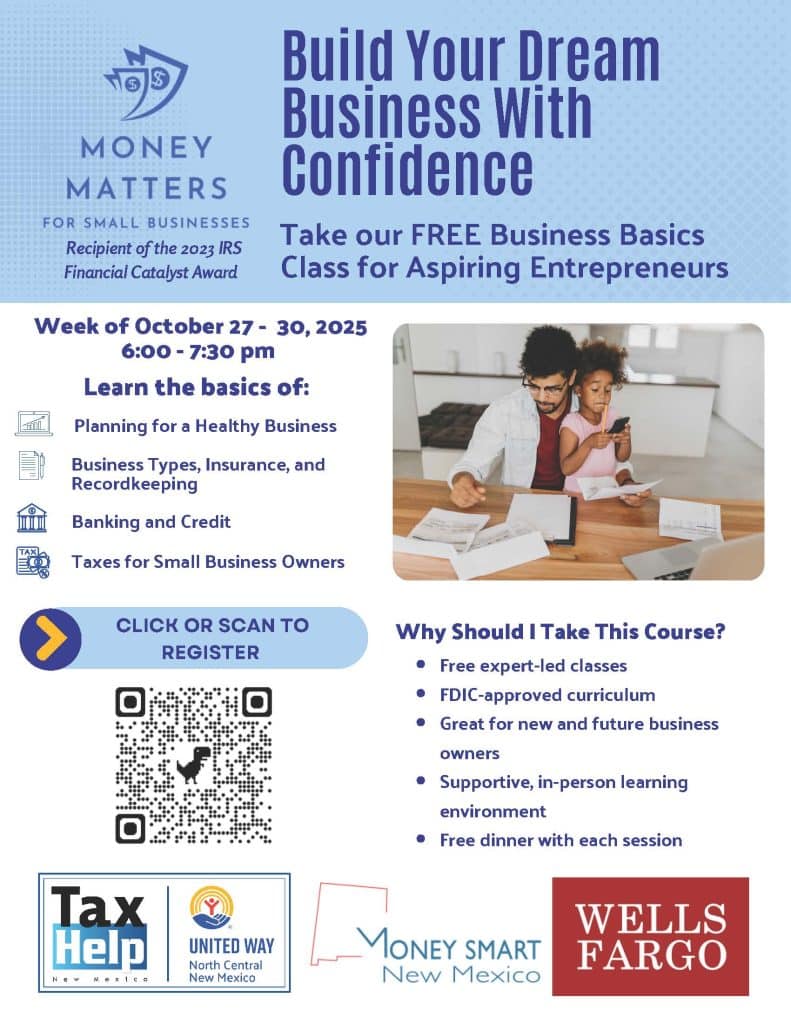

Join Us at a Money Matters Workshop

Become a Tax Help New Mexico Volunteer

Click above image to sign up today

Click the links below for more details

TAX HELP CHECKLIST OF NEEDED ITEMS TO BRING

Proof of Identification

Tax payer(s) must have a valid photo ID (Driver license, state issued ID, passport, military ID, tribal ID)

SOCIAL SECURITY CARD(S)

Social Security card(s) or ITIN (Individual Tax Identification Number) documents for yourself, your spouse, your dependents or anyone else on your return

BIRTH DATES

For you, your spouse and dependents on the tax return

INCOME FORMS

Wage and earnings statements (W-2, W-2G, 1099-R, 1099-Misc) from all employers

Interest and dividend statements from banks (Form 1099)

EXPENSE FORMS

All 1098 Forms, child or dependent care expenses (Daycare provider tax id # required), property tax payments

BANK INFORMATION

Bring your bank routing & account number for direct deposit (e.g.: blank check). If you do not have a bank account, please visit the Bank On Burque website for information on where to access safe, affordable, and functioning checking accounts.

PROOF OF HEALTHCARE

Form 1095-A, B and C, Health Coverage Statements or Health Insurance Exemption Certificate (if received)

MARRIED FILING JOINTLY

Both spouses must be present with proper documentation to complete tax return

OTHER DOCUMENTS

A copy of last year’s federal and state returns, if available, and all other tax-related documents